Binghamton University released a statement Wednesday afternoon outlining how the tax bill passed in the Senate last week will negatively affect the University and its students.

The B-Line news addition, penned by BU President Harvey Stenger and Provost Donald Nieman, said the bill would increase costs for enrolled students and deter others from pursuing a college education.

“We strongly believe the proposed changes will discourage individuals from pursuing a postsecondary education, make college more expensive for those who do enroll, and undermine the financial stability of public and private two- and four-year colleges and universities,” the news addition read.

The Senate’s bill, called the Tax Cuts and Jobs Act, is part of the GOP’s effort to overhaul the tax code. The House of Representatives’ version of the bill, which was passed on Nov. 16 with 227 Republican votes, repeals the student loan interest deduction, which allows individuals with a modified adjusted gross income of less than $80,000 to deduct up to $2,500 in student loan interest from their taxes. According to information from the Internal Revenue Service, more than 12 million Americans made use of these deductions in 2015.

The House tax plan also treats employer-provided tuition payments as taxable income, a provision that could hit graduate students hard. Graduate students often work in exchange for small stipends and waived tuition. Under the House bill, tuition waivers would count as taxable income, meaning many students could be taxed for more income than they actually have. According to the College and University Professional Association for Human Resources, approximately 145,000 graduate students and 27,000 undergraduate students receive tuition stipends annually. The American Council on Education estimates that the House bill’s provisions would collectively increase the cost to these students by more than $65 billion by 2027.

Although the Senate bill doesn’t contain these proposals, it will be revised in reconciliation, so the final bill could include the tuition provisions. According to the statement, the University has advocated for these changes to be revised or removed.

“We have expressed our views to our congressional representative, and to our two U.S. senators, Charles Schumer and Kirsten Gillibrand,” the statement reads.

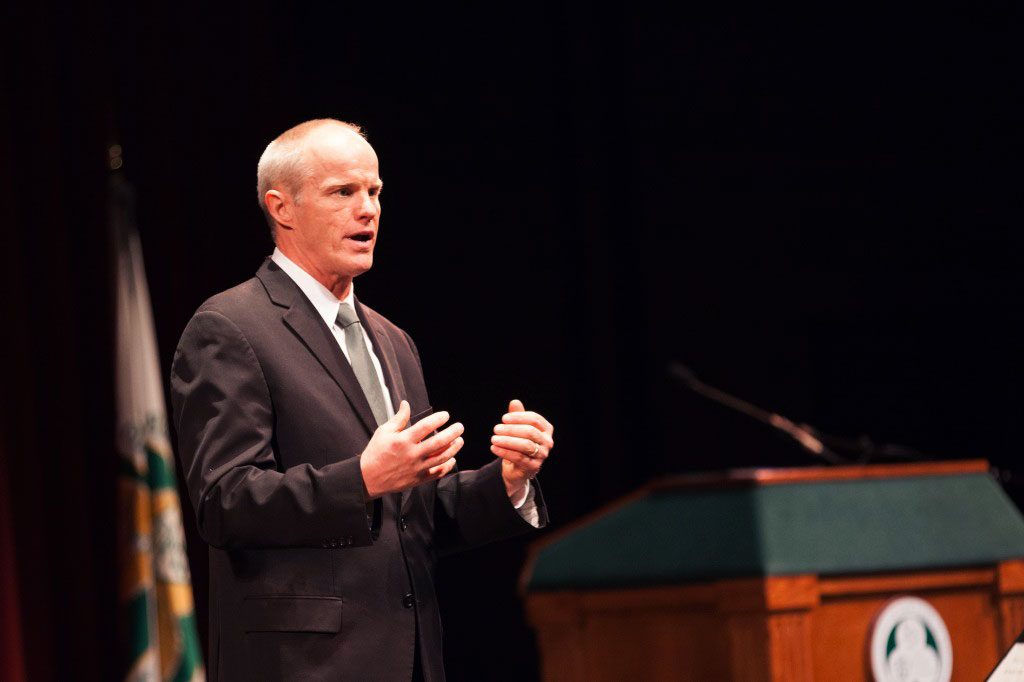

Other local leaders have also opposed the reform efforts. Last month, Binghamton Mayor Rich David held a press conference to discuss his concerns regarding the House version of the bill, which would eliminate the state and local tax deduction and the historic tax credit. According to David, these tax codes are crucial for middle-class New Yorkers and the reforms unfairly target citizens of highly taxed states like New York, New Jersey, Maryland and California.

“This is a common deduction that many people take advantage of, and its elimination will have a significant impact,” David said. “The number of [state and local tax] deductions per congressional district in this 22nd District is 62,530 deductions, so that’s a significant amount.”

Despite concerns regarding the overhaul, Stenger and Nieman encouraged students to remain hopeful.

“It’s important to stress that while the situation remains fluid and uncertain, we remain hopeful that these provisions will not be in the final bill,” the statement reads. “Regardless, we stand in strong solidarity with our students and will continue to explore all avenues to advocate against this bill.”

If the Tax Cuts and Jobs Act is finalized this year, its provisions are expected to take effect on Jan. 1, 2018.