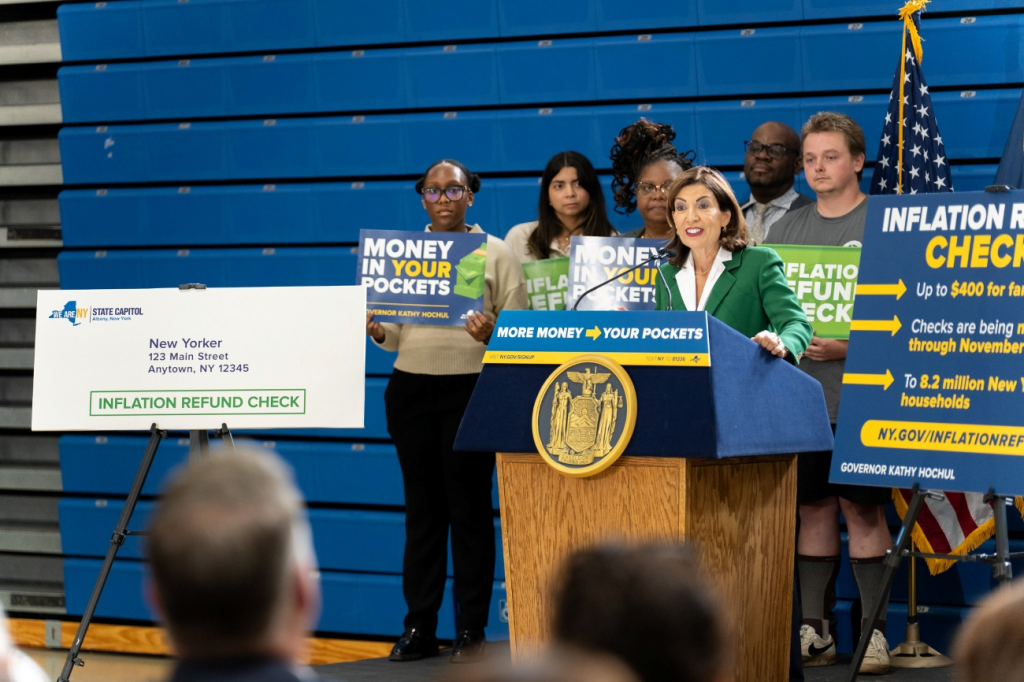

Over eight million New Yorkers are expected to receive “inflation refund” checks as part of an initiative by Gov. Kathy Hochul. The $2 billion program will distribute one-time checks ranging from $150 to $400 to eligible residents.

The checks are intended to provide relief to New Yorkers who now pay more in sales taxes due to inflation. From the end of September to November, qualifying New Yorkers will automatically begin receiving checks. The policy has faced disapproval from some progressive state lawmakers, who claim the initiative is misguided due to the Trump administration’s expected cuts to Medicaid and other social services that increase next year’s state budget deficit.

The amount taxpayers receive will depend on how they filed their taxes and the income they received in 2023. The highest check is $400, which will be awarded to married individuals who filed jointly and to qualifying surviving spouses who earned $150,000 or less. Single individuals, married couples filing separately and heads of households who made between $75,000 and $150,000 will receive $150.

To qualify for the checks, full-year residents must have filed a New York State Resident Income Tax Return, reported an income of less than $300,000 a year and must not have been claimed as a dependent on another taxpayer’s return.

Since full-time undergraduate students can be claimed as dependents on their parents’ tax returns if they are under 24 years old and receive over a majority of their financial support from their parents, many will not receive a check. Still, some graduate students meet the qualifications.

Viktorya Erdogu, president of the Graduate Student Employees Union chapter at Binghamton University and a third-year Ph.D. student studying political science, spoke with Pipe Dream about the economic concerns of graduate student workers and how the rebates might impact them. She addressed how the base stipend for doctoral students at the University, which they bargained to increase to $25,000 per year starting January 2026, still lags behind the minimum annual living wage needed in Broome County of about $40,000, according to the Massachusetts Institute of Technology’s living wage calculator.

“We do appreciate that [Hochul’s] trying to help, but this one-time payment isn’t a solution, and we’re advocating for fair wages, for better benefits, including health insurance, for all TAs and GAs, all grad student workers across the SUNY system,” Erdogu said.

Hochul has argued these inflation rebate checks will put money back in the pockets of New Yorkers, who now pay a higher price for many household items due to inflation.

According to ABC’s price tracker, overall grocery prices in the Northeast are 27.3 percent higher than they were in January 2015. The cost of living in New York in 2025 is 27 percent higher than the national average.

As prices rise, New Yorkers are paying more for purchased items and sales taxes on those goods. According to Hochul, the rise in sales taxes increased state revenue by over $2 billion, which will directly finance refund checks.

“It dawned on me instantly — this doesn’t belong to us,” Hochul said at a press conference, referring to New York’s surplus sales tax revenue. “This is because hard-working New Yorkers got slammed with higher costs of everything.”

Hochul, State Sen. Lea Webb ‘04 and Assemblywoman Donna Lupardo did not respond to repeated requests for comment.

Some progressive state lawmakers believe the money would be better spent on closing the state’s projected $10.5 billion deficit gap to thwart deep cuts to social services. According to Blake Washington, the state’s budget director, federal funding cuts contribute at least $3 billion to the shortfall.

In August, some state lawmakers held a rally in Manhattan and criticized the rebates, calling on Hochul to convene a special state legislative session to raise taxes on the wealthy to fund social services like the Supplemental Nutrition Assistance Program and Medicaid that were cut by the Trump administration’s “One Big Beautiful Bill” act.

“We have a responsibility to actually tax the ultra-wealthy and big corporations,” said Lt. Gov. Antonio Delgado at the rally. “ Two billion dollars — that could be very useful right now.”

Additionally, since the program sends out checks instead of acting as a tax credit, the checks will be subject to federal income tax, providing hundreds of millions of dollars to the federal government. New Yorkers will have to report the rebates on their income tax returns next year.

Hochul has been criticized for a comment she made in September at the True Bethel Baptist Church, a predominantly Black congregation in Buffalo, New York, regarding inflation refunds.

“Don’t spend it all in one day,” she told the congregation. “Get something you really need, OK? Don’t stop by the liquor store, OK? Buy something for the kids — buy them some food.”

Following the remarks, she stated, “Sometimes I have to stop by the liquor store too. I understand. It’s alright. It’s alright.”

Sarafina Chitika, Hochul’s campaign spokesperson, claimed the moment was not racist and instead was intended to be lighthearted and self-deprecating.

Republicans in the state legislature condemned the policy as insignificant and not doing enough to help New Yorkers.

“I never say no to giving money back to our taxpayers, but it’s a gimmick,” said Edward Ra, a Republican assemblyman from Nassau County. “It’s a one-shot initiative.”