On Oct. 2, a group of students from the Binghamton University Finance Society won the Ross Investment Competition at University of Michigan’s Ross School of Business, taking home a $3,000 cash prize.

The four students were invited to participate in the competition early last week, and drove to Michigan over Rosh Hashana weekend. They took home first place, beating a field of almost 30 teams, including multiple Ivy League universities.

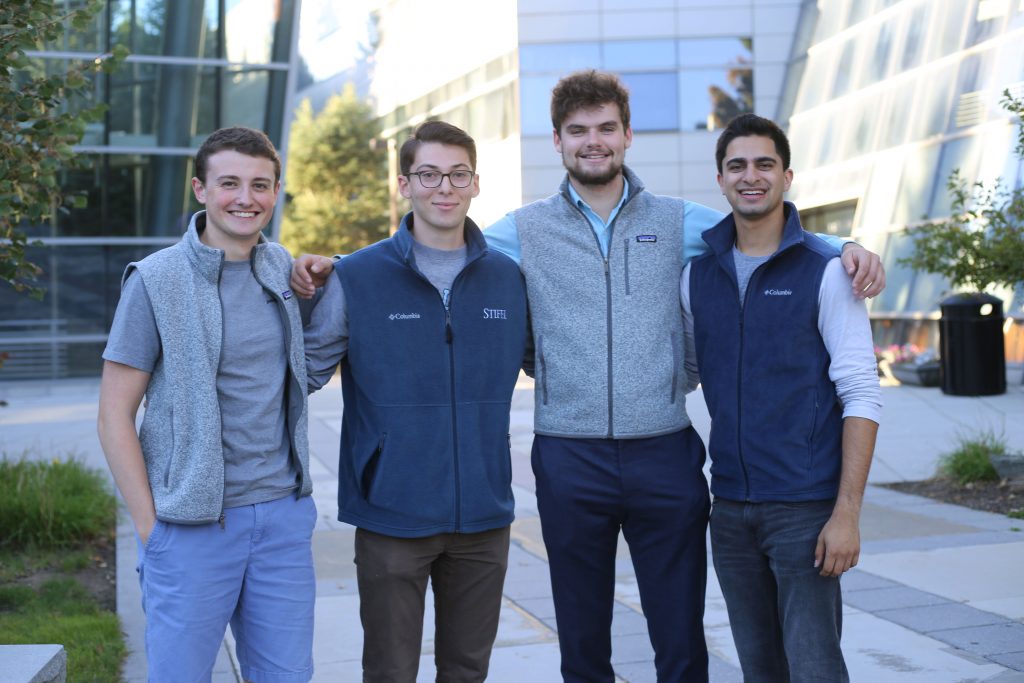

The students are Robert Pim, the president of the Binghamton University Finance Society and a senior majoring in business administration; Jonathan Heller, a sophomore majoring in business administration; Brandon Fine, a senior majoring in accounting; and Ronick Sanon, the vice president of the Finance Society and a senior in the individualized major program.

At the competition, the different student groups pitched stock investments to a panel of judges from national investment firms that chose the winner based on the likelihood of their analyses coming to fruition. The stock pitches were designed to provide a current snapshot of what the stock is trading at currently, with the groups providing evidence for their predicted trends.

While most groups chose to pitch stocks expected to experience traditional growth, the group from BU instead chose to pitch the idea of shorting a stock. Shorting a stock entails borrowing a stock while betting against it, meaning the stock is expected to fail, and then immediately selling those shares once borrowed. Once the stock falls, they are bought back at a lower price than they were sold for, and then returned to the broker.

Their pitch focused on GATX Corporation, a railcar-leasing company. The company leases railcars to railroads and companies looking to transport their product by freight rail. The company was chosen based on supply and demand principles, with a commodity boom in 2014 leading to an overabundance of railcars in 2016. Without the demand for the cars, the BU student group stated its belief that the stock price of GATX is destined to fall by almost 30 percent in the coming months.

To justify its analysis, the group pointed to three different market catalysts they believed would have a direct influence on the stock’s future performance. They examined the stock’s lease price index, one way a lease’s price is gauged, and found that it had fallen into the negatives for the first time since the financial crisis of 2008. The company’s rate of customer renewal had also fallen by almost 20 percent over the last few quarters, leading the group to believe this trend would continue. Finally, the group looked at the utilization rate of GATX’s fleet and saw that it was beginning to fall.

“One thing the judges did say that made our pitch stand out was that it’s kind of hard to convince someone what you’re going to say is going to happen like the other pitches,” Sanon said. “But it’s a lot easier to fundamentally lay out supply versus demand, this is exactly why it’s not going to work and this is why the market is evidently not appreciating that.”

As president of the Finance Society, Pim was not only personally excited for the group’s win, but he hoped that the win would help BU gain greater name recognition nationally for all of the hard work put in by students and professors.

“It’s huge for the school,” Pim wrote in an email. “We are constantly trying to compete with larger schools, and show that you can get a ‘big business school education’ at Binghamton for significantly less. These competitions demonstrate that our finance students can go toe-to-toe with students from schools like Harvard, Michigan, Duke, and NYU and beat them.”

The cash prize will be split equally between Sanon, Pim, Fine and Heller.