The Student Association (SA) Congress’ Student Life and Academics Committee (SLA) hosted “Financial Literacy Night” on Friday to educate students on money and finances.

The event featured a talk from a Binghamton University lecturer in economics and several clubs and organizations from across campus, including the Accounting Association, the Alpha Kappa Psi business fraternity, Financial Literacy for the Youth (FLY) and Visions Federal Credit Union. The organizations present answered questions concerning money, credit cards, taxes, investing and other financial literacy topics.

Kenneth Christianson, a lecturer in economics, spoke about the effects the COVID-19 pandemic has had on the economy and addressed gross domestic product rates, loans, unemployment rates and the harms and benefits of inflation. He emphasized the importance of learning how to properly save money, especially in one’s college years.

“You’ve got 50 or 60 years ahead of you in terms of your financial life, before you retire anyway,” Christianson said. “And if you start saving now, that’ll be very powerful. Put $100 in the bank now it’ll be worth $10,000 or something by the time you retire. So saving can really do a lot to try to increase your ability to be prosperous in the future. Also, it will help your credit score out.”

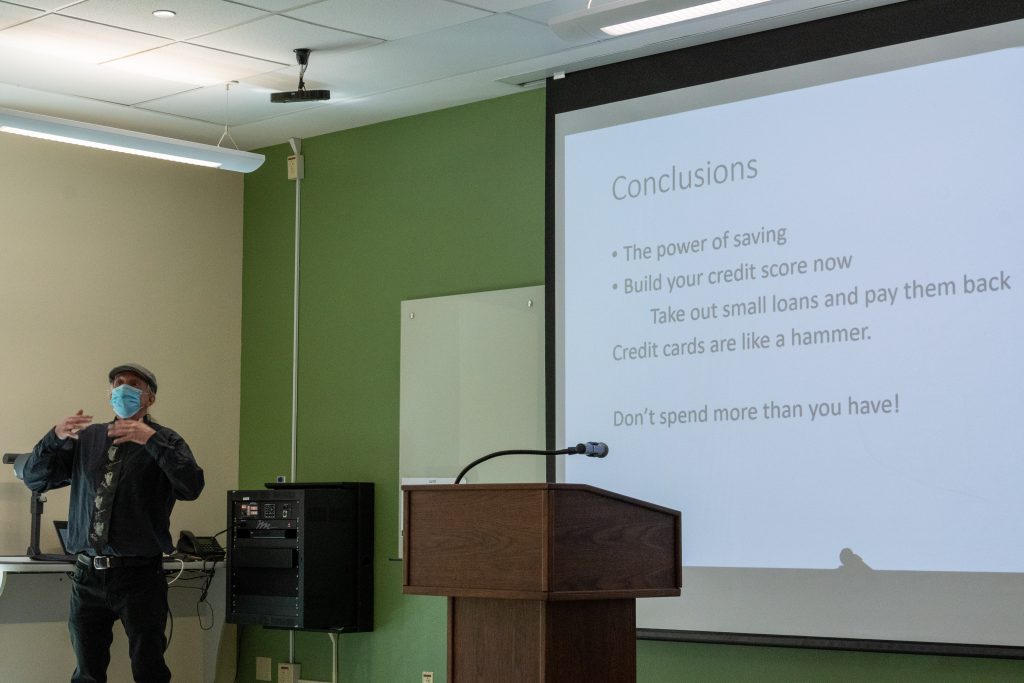

Christianson said credit card use, which may appear harmless to many, could be the difference between a good or bad financial standing.

“Credit cards are really useful for emergencies, and for when you need to make purchases but you don’t have the cash on hand,” Christianson said. “But [credit cards are] like a hammer. You’ll use them but then [credit cards] really smash and mess up your financial situation, credit score, stuff like that. Just don’t spend money that you don’t have.”

Christianson said there are ways to protect both one’s financial standing and credit score. He explained how collectively, consumption determines production.

“A good starting point for all of this is just to recognize where your dollars go,” Christianson said. “Where you spend your money makes a difference.”

Eden Greenberg, event organizer, chair of the SLA and a junior majoring in human development, explained the process by which the SLA chose its speaker. Greenberg said she believed Christianson’s knowledge on the subject may be able to fill in educational gaps.

“He knows a lot about inflation and also [gross domestic product], and on top of that the actual financial education and the literacy on going about saving your money,” Greenberg said. “Like what bank you should choose and how you establish a credit score. These are the questions that a lot of students don’t get answered, and are just thrown into the world of money.”

Greenberg said the event was a good way for students to learn more about managing money and change the way they think about the economy.

“I think a lot of the time we are thrown into this world and financial education is the one thing that we miss,” Greenberg said. “It’s never a subject in school. And honestly, unless you’re interested in business, you don’t really get that exposure. [The SLA] thought it would be really important to have an event, where you can sit and visit organizations that aren’t intimidating, since they are students just like us, but maybe they know a little more about saving money or money tips that you’ve never thought about.”

Edon Prelvukaj, president of FLY and a junior majoring in economics, said he agreed that financial literacy has not been properly taught in schools. Prelvukaj said he and his club members had chosen to table at “Financial Literacy Night” because it fits in with their overall mission to spread financial knowledge to students, who will then hopefully spread their knowledge into communities.

“We think that financial literacy is a crucial aspect of life,” Prelvukaj said. “When I was first developing this organization, I went in with the intention of helping as many people as possible, because financial literacy isn’t really something that is often taught, and it is probably one of the most crucial aspects of any adult’s life.”